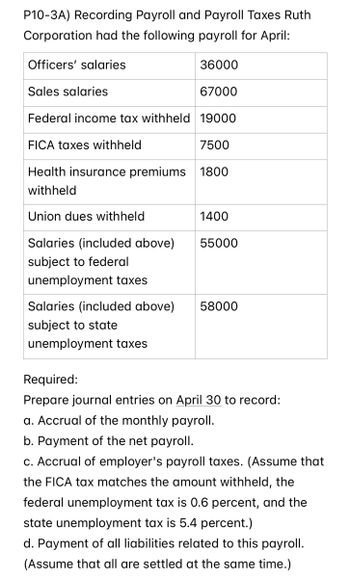

FEDERAL INCOME TAXES Social Security - FICA Federal Withholding Tax (social security/medicare) W4 W2. - ppt download

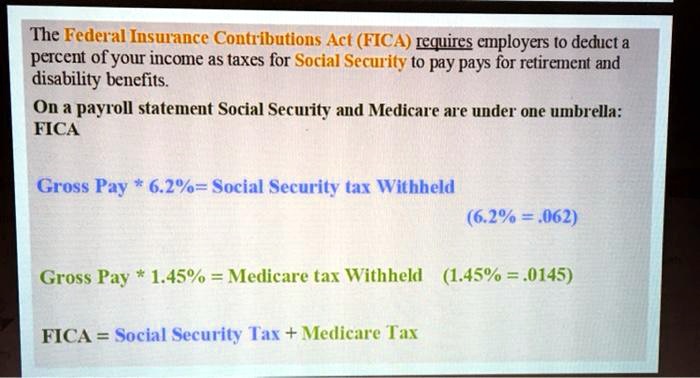

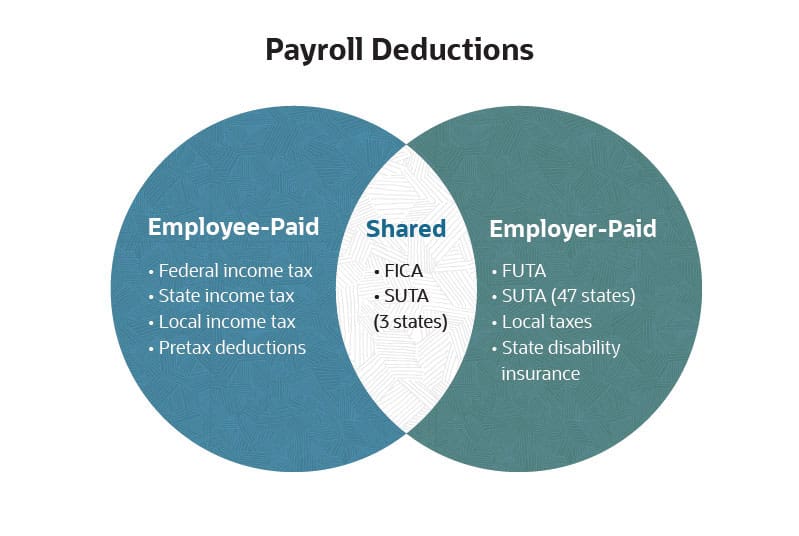

SOLVED: The Federal Insurance Contributions Act (FICA) requires employers to deduct a percentage of your income as taxes for Social Security to pay for retirement and disability benefits. On a payroll statement,

Solved: BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 pa [algebra]

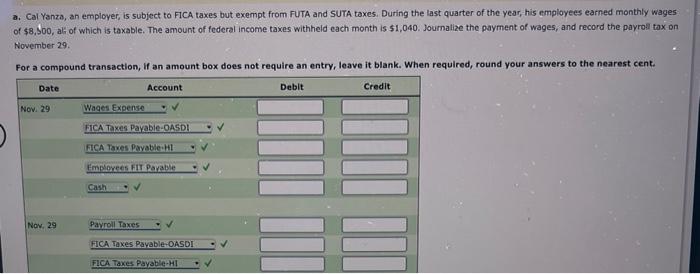

✓ Solved: a. Cal Ruther, an employer, is subject to FICA taxes but exempt from FUTA and SUTA taxes. During...

.jpeg)

:max_bytes(150000):strip_icc()/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)